The introduction of mandatory electronic invoicing in Germany marks a significant step towards the digitalization of business transactions. From January 1, 2025, it will be mandatory for all companies to receive electronic invoices for taxable domestic B2B sales. One year later, from January 1, 2026, companies will also have to be able to create and send electronic invoices.

The benefits of this change range from cost savings to speeding up payment transactions and supporting more sustainable business practices by reducing paper consumption.

For companies, however, this now means that they need to create the necessary structures to be able to receive, process and send invoices electronically. This requirement highlights the importance of innovative software solutions such as speedikon C, which allow companies to prepare for and benefit from these new requirements.

With the spirit of technical innovation in mind, we already offer our customers a seamless integration into electronic invoice processing. With the ability to enter orders and the associated invoices directly into speedikon C, to check them and then to automatically transmit them to accounting systems, we not only support companies in meeting legal requirements, but also in optimizing internal processes, resulting in significant time and cost savings.

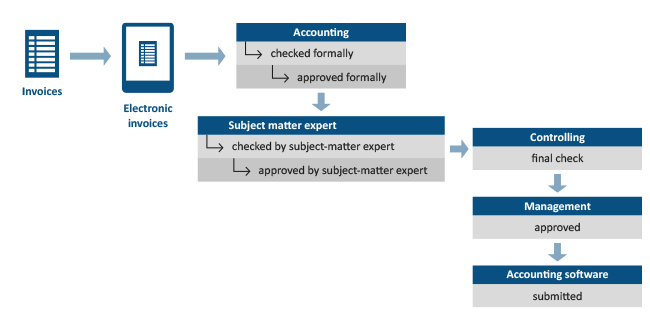

The entire process is completely digital: speedikon C enables the receipt of electronic invoices from an electronic invoice portal and automatically analyzes the individual invoices in order to assign them to an existing order in speedikon C. If assigning them is not possible, the invoice is stored in a collective folder for further processing. Employees then have the option of checking the invoice and invoice items and finding the corresponding order. Alternatively, they can also generate and create a new order in the system directly from the invoice with just one click. The responsible employees then check, approve and send the digital invoice to any accounting system electronically. In addition, speedikon C enables the documentation and allocation of credit notes and cancellation invoices as well as their transmission to accounting systems.

This workflow has proven to be extremely beneficial for the public sector in particular. Previously, an average of thousands of orders per year and the associated invoices were processed manually. This formerly time-consuming process of checking and approving invoices, which could take weeks, is now carried out electronically in a fraction of the time. This not only allows discounts to be utilized more quickly, but also enables more precise control and monitoring of cash flows.

In future, we’re planning for speedikon C to be able to process construction invoices and debit notes, which place special demands on invoice processing due to their complexity. It should also be possible to prepare and send invoices with speedikon C to an electronic invoicing portal.

Would you like to be able to process invoices digitally? Contact us and we will take a look at your use case!